Brazil Energy S.A. has the goal of becoming a reference in the power generation industry in the country, especially by the quality of assets that comprise its portfolio, by the capability of identification, development and implementation of projects, as well as by the profitability of the investments made.

With this current scenario of macroeconomic stability as a background, Brazil Energy guides its investment decisions, always aiming at increasing the market value of the company and achieving higher returns to its shareholders.

The investment strategy followed by Brazil Energy also looks to reduce the investment risks with the diversification of its assets. The investments are diversified by generation source, development stage, location and customer base (PPAs). The diversification of investments by Brazil Energy has the purpose of forming a balanced portfolio that can maximize the return for shareholders in the long term and also mitigate certain risks incurred.

Each energy source has its own characteristics and risks. When making diversified investments, the natural complementarity existing among the sources enables the reduction in the total portfolio risk.

In Brazil, there are two examples of natural complementarity:

- Hydroelectricity x Wind Power: the dry season of the year (period between May and November) usually has a higher incidence of winds in Brazil; and

- Hydroelectricity x Biomass: the dry season occurs during the sugarcane harvest season in the mid-southern region, corresponding to 90% of the total production of the country. Sugarcane is the major biomass source for power generation existing in Brazil.

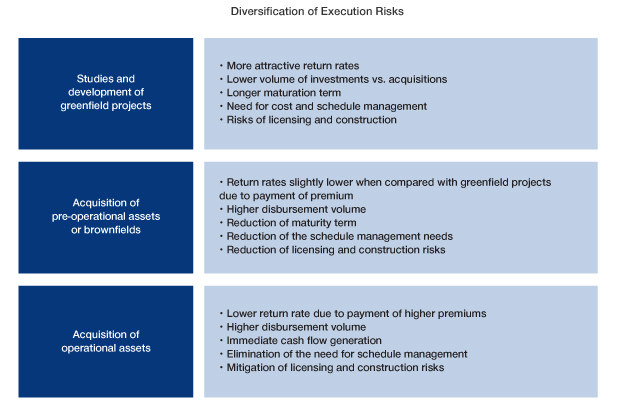

In addition, it is also important to mitigate the risks of execution. The development of studies and start-up projects, in general, provides higher returns, compatible with a higher level of development and construction risks.

On the other hand, more mature, or even operational, projects show lower levels of risk of execution, offering comparatively lower returns on investment.